All Categories

Featured

Table of Contents

The application process for level term life insurance coverage is generally really straightforward. You'll complete an application which contains basic individual details such as your name, age, and so on in addition to a more thorough survey regarding your case history. Depending on the plan you're interested in, you might have to join a medical checkup procedure.

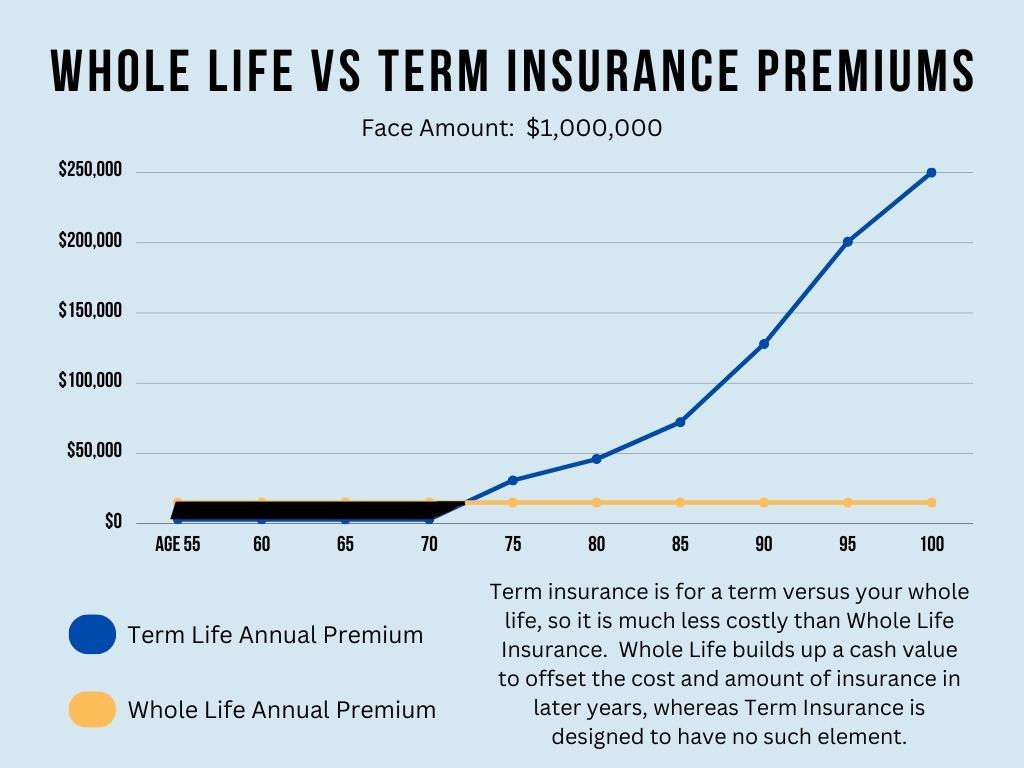

The short answer is no. A degree term life insurance policy plan does not build cash worth. If you're seeking to have a plan that you're able to take out or borrow from, you may explore long-term life insurance. Entire life insurance policy policies, as an example, allow you have the comfort of fatality benefits and can build up cash money value in time, suggesting you'll have much more control over your advantages while you live.

Riders are optional stipulations added to your plan that can give you added advantages and defenses. Anything can take place over the training course of your life insurance term, and you want to be all set for anything.

There are circumstances where these advantages are built into your plan, but they can likewise be offered as a different addition that requires additional payment.

Exceptional Does Term Life Insurance Cover Accidental Death

1Term life insurance coverage offers temporary security for a vital period of time and is typically less pricey than long-term life insurance policy. 2Term conversion standards and constraints, such as timing, may apply; for instance, there may be a ten-year conversion advantage for some items and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance Acquisition Alternative in New York. 4Not readily available in every state. There is a price to exercise this biker. Products and cyclists are available in approved territories and names and functions might vary. 5Dividends are not assured. Not all participating policy owners are qualified for dividends. For select bikers, the problem uses to the guaranteed.

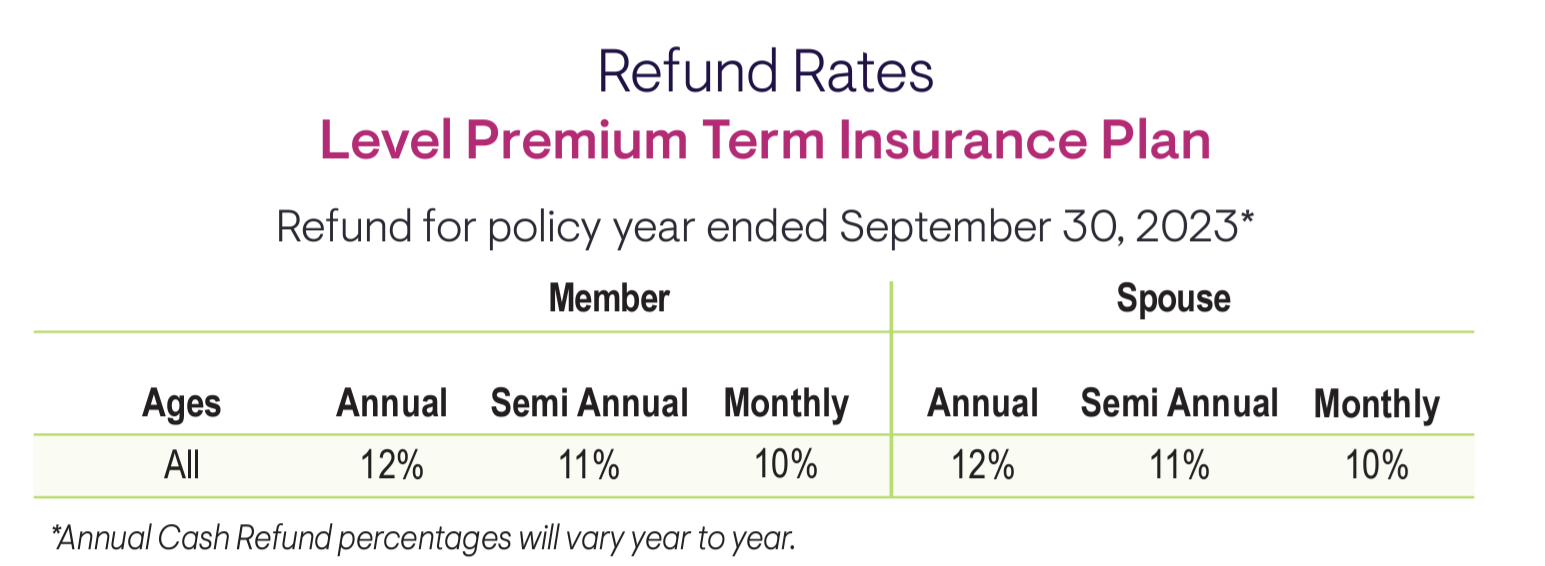

(EST).2. Online applications for the are readily available on the on the AMBA internet site; click on the "Apply Now" blue box on the best hand side of the page. NYSUT participants can additionally publish out an application if they would prefer by clicking the on the AMBA web site; you will then need to click "Application" under "Kinds" on the right hand side of the page.

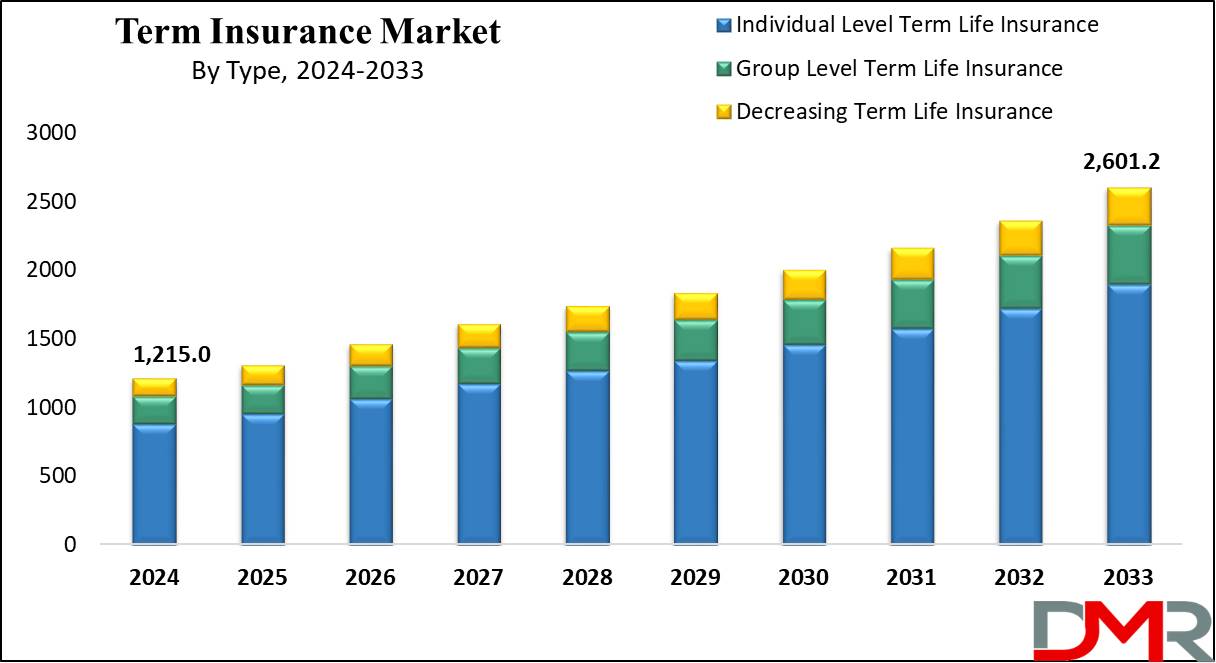

Trusted Decreasing Term Life Insurance

NYSUT members enrolled in our Degree Term Life Insurance Policy Strategy have actually access to offered at no extra price. The NYSUT Member Advantages Trust-endorsed Degree Term Life Insurance Policy Strategy is underwritten by Metropolitan Life Insurance policy Firm and provided by Association Participant Conveniences Advisors. NYSUT Pupil Members are not qualified to take part in this program.

Term life coverage can last for a collection amount of time and commonly has preliminary prices that increase at established intervals. Usually, it does not build cash value. Long-term life insurance coverage, also known as entire life insurance coverage, can last your entire life and might have higher initial rates that do not usually boost as you age.

Our term life choices include 10, 15, 20, 25, 30, 35, and 40-year policies. The most prominent type is level term, implying your payment (premium) and payment (death benefit) remains level, or the same, till completion of the term period. This is one of the most straightforward of life insurance policy alternatives and needs extremely little maintenance for policy proprietors.

For example, you can offer 50% to your spouse and split the rest amongst your grown-up kids, a moms and dad, a pal, or perhaps a charity. * In some circumstances the survivor benefit might not be tax-free, find out when life insurance coverage is taxable.

This is no matter whether the insured person dies on the day the policy begins or the day prior to the plan ends. In other words, the quantity of cover is 'level'. Legal & General Life Insurance is an instance of a level term life insurance plan. A level term life insurance policy plan can suit a vast array of circumstances and needs.

Your life insurance policy plan could also create component of your estate, so can be subject to Estate tax found out more about life insurance policy and tax obligation. voluntary term life insurance. Allow's take a look at some attributes of Life insurance policy from Legal & General: Minimum age 18 Maximum age 77 (Life Insurance Policy), or 67 (with Crucial Disease Cover)

Dependable Term 100 Life Insurance

What life insurance policy could you think about otherwise level term? Decreasing Life Insurance Policy can help protect a repayment mortgage. The quantity you pay stays the same, yet the degree of cover decreases approximately according to the method a settlement mortgage reduces. Lowering life insurance can help your liked ones remain in the household home and prevent any more disturbance if you were to die.

Life insurance coverage is a vital method to safeguard your loved ones. Degree term life insurance policy is what's known as a level costs term life insurance plan.

A level term life insurance coverage policy can offer you comfort that the people that rely on you will certainly have a survivor benefit during the years that you are planning to support them. It's a means to help look after them in the future, today. A degree term life insurance (occasionally called degree premium term life insurance policy) plan supplies protection for a set variety of years (e.g., 10 or twenty years) while maintaining the costs payments the very same for the duration of the plan.

With degree term insurance coverage, the cost of the insurance policy will remain the exact same (or possibly lower if dividends are paid) over the regard to your plan, generally 10 or twenty years. Unlike permanent life insurance, which never ends as lengthy as you pay premiums, a degree term life insurance policy policy will certainly end eventually in the future, typically at the end of the period of your degree term.

Long-Term Short Term Life Insurance

As a result of this, many individuals utilize permanent insurance coverage as a secure financial preparation tool that can offer many needs. You may be able to convert some, or all, of your term insurance coverage during a set period, typically the initial ten years of your policy, without needing to re-qualify for coverage even if your wellness has transformed.

As it does, you might want to include to your insurance coverage in the future. As this takes place, you may desire to ultimately lower your fatality benefit or take into consideration converting your term insurance to a permanent policy.

Latest Posts

Burial Policy Cost

Life Insurance And Funeral Expenses

Final Expense Insurance Policy